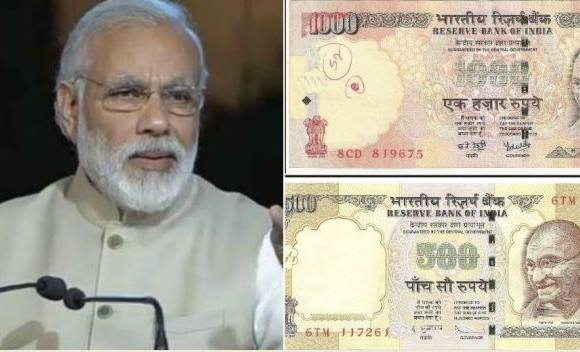

Prime Minister Narendra Modi, on a surprise address to the nation yesterday, announced the withdrawal of 500 rupee and 1000 rupee notes to address the issues of corruption, hoarding of black money and circulation of counterfeit currency. The announcement was put to action immediately – and within a few hours all the 500 rupee and 1000 rupee notes in India ceased to be legal. This is one of the major economical move taken by the incumbent government.

The decision has been welcomed by most of the people in country and social media platforms are overflowing with messages and memes about Modi’s unexpected move to counter corruption. The Prime Minister further announced that instead of the 500 rupee and 1000 rupee notes, Reserve Bank of India (RBI) would soon be issuing 2000 rupee notes.

The Immediate Repercussions

Banks and ATMS will be closed on November 9th and 10th to allow banks make the transition smoothly. Once the banks reopen, withdrawals from banks will be capped at Rs. 10,000 in a day and Rs. 20,000 in a week. When the ATMs start functioning, the withdrawals will be capped at Rs. 2,000 per debit card per day and will be later increased to Rs. 4,000. The payment through internet banking, cash, cheque, demand drafts or debit/credit cards will work as usual. However, there are going to be three obvious challenges:

- The first and foremost impact would be the limited circulation of currency for some time.

- The common people will have to rush to bank exchange the notes.

- This period is going to be difficult for people who runs small businesses and are not well versed with the money transactions online or through mobile banking.

The Mechanism to Counter Immediate Repercussions

This move doesn’t mean that the 500 rupee and 1000 rupee notes that you have will be of no use. You can use these notes at several places. If you are a tourist in India, you can change the notes at the airport. If you are a resident Indian, then:

- You can use these notes at the railway, bus and air tickets counters, petrol pumps, consumer cooperatives, government hospitals and milk booths till November 11.

- You can deposit these notes in your bank and post office accounts between November 10th and December 30th.

- You can exchange the money up to a value of Rs. 4,000 with currency of lower denominations from designated bank or post office branches till November 24th by showing a valid government identity card such as PAN card, Aadhar card, Voter ID card and so on.

The Reserve Bank of India will issue new Rs. 500 and Rs. 2,000 notes starting from November 10th. It is being estimated that it will take approximately two to three weeks to replace all the old notes in circulation.

How This Move Counters Black Money and Corruption

Though this is the first of its kind of move in India, countries like Mexico, Argentina, Turkey, Israel, and Germany have successfully introduced such measures in their country in the past. This looks like an effective method to force people to disown and bring out the hoarded black money that they have been hiding so far.

Imagine a simple situation – if you are a rich man with illegally stocked 500 rupee and 1000 rupee notes, you can’t approach a bank to convert all of them as there is a upper limit for banks to exchange. If you deposit it into your account, you will unintentionally declare the wealth that you have illegally held so far. The situation will be same for corrupt politician who has hoarded money for election expenses or a landlord in far-flung village who has not declared his assets.

This method will also bring an end to the circulation of counterfeit currency notes. The RBI knows from its records how much of these currency notes have been issued. So, when these currency notes are devalued, the RBI will only release the new currency of lower or higher denomination which will together be equivalent to the total value of the banned currency notes. The counterfeit currency notes will be, therefore, ousted automatically.

What to Expect in Future

This move will bring out some sudden and some long-term changes in the Indian economy:

- Sudden deflation: People who earn money through illegal means will not declare their money which will lead to reduction in the total currency in circulation– and therefore, in the beginning, there will be a huge deflation. Deflation will increase the value of money. While the money supply will go down, the commodities available in the market will be available. This would subsequently lead to a drop in the prices of gold, stocks and commodities.

- Gradual inflation: Banks will have more cash – as people who have a lot of cash, legally earned, will also deposit it in the banks. Banks, with cash at their disposal, will be able to give out loans at lower interest rates. This will lead to inflation. However, this inflation will not happen overnight. The deflation and inflation will counter each other and bring a balance in the economy.

- Bring transparency to the economy: As the transactions will become more transparent, the artificial increase introduced in real estate, higher education and healthcare due to availability of black cash will come down. This will make the Indian market credible and more attractive for Foreign Direct Investment (FDI).

- Increased national security: National security will increase as the smuggling of currency and money laundering used to finance terror in the country will no more be available.

The challenges ahead

While the move may be in the right direction, there are challenges on the way. If the aim is to create a cashless society in the long run, there needs to be more concrete effort on bringing more and more people from rural India on the banking platform. The Jan Dhan Yojna, the digital payment stack and payment banks are policies and ideas are still in an emerging stage. It will take a long time and concentrated efforts from all quarters to bring the Indian population to reap the real benefits of the changes brought out by this move.